How Much Does It Cost to Buy a House? (Out of Pocket Costs)

Out of Pocket Costs

Understanding Out-of-Pocket Costs When Buying a House in Michigan

Buying a home is a major investment, especially for first-time buyers. Knowing the true cost of purchasing a home—including out-of-pocket costs—helps you prepare financially and avoid unexpected surprises. Here’s a breakdown of the typical expenses you’ll encounter when buying a house, so you can go into your home search with confidence and a clear budget.

What Are Out-of-Pocket Costs for Home Buyers?

Out-of-pocket costs are all the expenses you’ll need to cover with your own funds when buying a house. These include earnest money, inspection fees, appraisal costs, closing costs, and the down payment. Let’s dive into each of these and see how they contribute to the total cost of buying a house.

Earnest Money Deposit

The earnest money deposit is a “good faith” amount paid to the seller to show you’re serious about purchasing the home. This deposit, typically around 1% of the home’s purchase price, is credited toward your final payment at closing. It’s important to have this ready to go as soon as your offer is accepted. It’s also refundable if the deal doesn’t go through due to specific contingencies.

Home Inspection Fees

During The Inspection Period , you’ll need to pay for a professional home inspection, which generally costs between $400 and $600. Additional inspections, like radon, pests, or septic systems, for example, can add $100–$400 each. It adds up, but these inspections are crucial for identifying issues that may need repairs or cause further negotiation with the seller. Spending this money upfront could save you tens of thousands later.

Appraisal Fees

An Appraisal is required by your lender to confirm the home’s value before approving your loan. Appraisal fees usually range from $500 to $700 and ensure that you’re paying a fair market price. Like the inspection, this fee is a one-time expense paid before closing.

Closing Costs and Prepaids

Closing Costs , which generally amount to 3%–5% of the home’s purchase price, cover a variety of fees involved in finalizing the transaction. These may include:

- Lender fees (e.g., origination, processing, underwriting fees)

- Title insurance and title search fees

- Recording and government fees

- Escrow fees (for initial property taxes, insurance, etc.)

Prepaid Costsoften include the first few months of property taxes, homeowners insurance,and mortgage interest. These can be higher in certain areas, so it’s good to estimate with local taxes in mind.

For example, total property tax rates in the Howell school district within Howell Twp are slightly higher than in Howell school district within Brighton Twp.

Down Payment

The down payment varies pretty widely based on loan type and lender requirements. Conventional loans often require around 5%-20%, while FHA loans may need as little as 3.5%. Some programs, like VA and USDA loans, offer 0% down payment options. Knowing your down payment amount in advance will help you accurately estimate the total upfront cost to buy a house.

How Much Does It Really Cost to Buy a House?

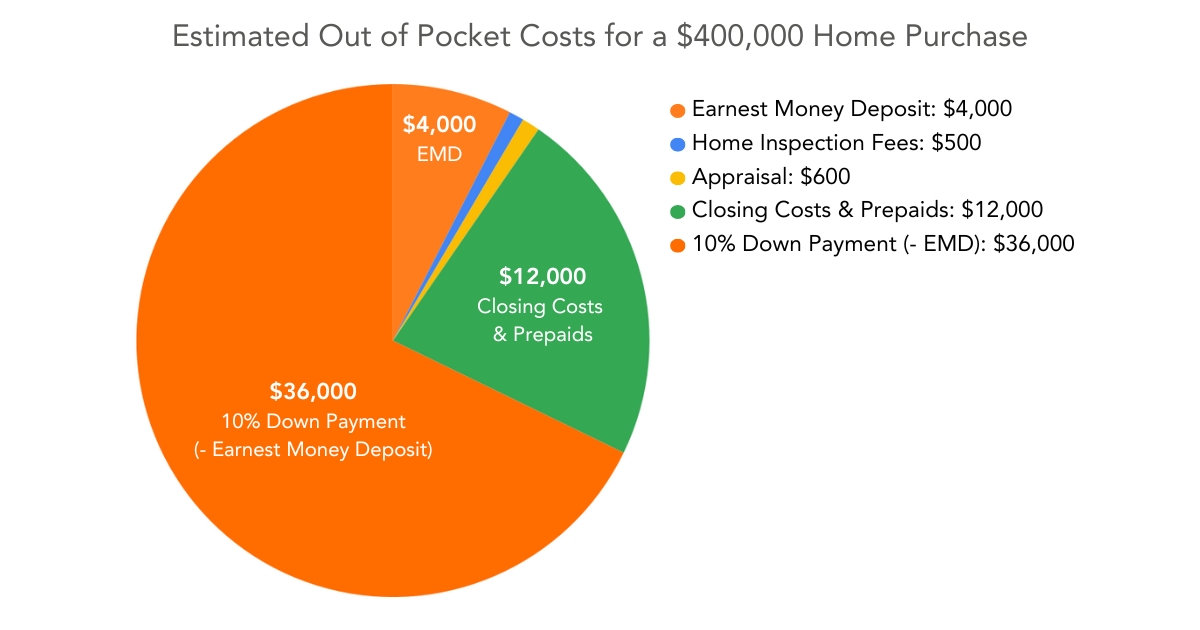

Let’s put it all together and walk through an example. Let's say you're purchasing a home for $400,000:

Home Purchase Price:$400,000.

Earnest Money:$400,000 x 1% = $4,000.

Home Inspection Fees:We’ll use the average between $400 - $600 = $500.

Appraisal:We’ll again use the average between $500 - $700 = $600.

Closing Costs and Prepaids:Let’s use the lower end of the closing cost range of 3%. So $400,000 x 3% = $12,000.

Down Payment:For this example, we’ll use a 10% down, conventional loan which calculates to $400,000 x 10% = $40,000.

This appears to total $57,100 in Out-of-Pocket Costs. However, you're not actually paying that much,because your Earnest Money Deposit is credited back to you when you close.

We consider the Earnest Money Deposit an Out-of-Pocket Cost because you need to be aware of it upfront and submit it when you make an offer. But when all is said and done, the EMD counts as a chunk of your closing costs that you've already paid. You can think of it as part of your Down Payment.

Here it is displayed in a cleaner way:

| Earnest Money Deposit | $4,000 |

| EMD is shown here because it's paid early in the process | |

| Home Inspection Fees | $500 |

| Appraisal Fees | $600 |

| Closing Costs and Prepaids | $12,000 |

| Down Payment | $40,000 |

| Earnest Money Deposit | - $4,000 |

| EMD is credited toward your total cost at closing | |

| = | $53,100 |

So that's how much you'd be paying out of pocket, in total, in this example.

While this is a total amount you could expect to pay, it's not paid all at one time. By the time you get to the closing table, the Earnest Money Deposit, Inspection Fees, Appraisal Fees, and Prepaids will have already been paid at their respective times.

When planning your budget, also keep in mind these costs may fluctuate based on factors like home price, loan type, and location.

Tips for Managing Out-of-Pocket Costs

If you’re concerned about the upfront expenses, consider the following tips to effectively manage and reduce your out-of-pocket costs:

- Shop around for lenders who offer favorable terms and reduced fees.

- Look into local first-time buyer programs that may offer down payment assistance. A good lender will be able to make you aware of these if any apply to you in your area.

- Discuss costs with your real estate agent, who can advise on ways to negotiate so that the seller may help with closing costs or other fees.

Ready to Start Your Home Buying Journey?

Understanding the total cost to buy a house, including hidden fees and out-of-pocket expenses, will set you up for a smoother, more confident home-buying experience. With the right information and guidance, you’ll be well-prepared to make one of life’s biggest financial decisions.

Ready to take the next step in your home-buying journey? We’re here to answer your questions and help you navigate the home-buying process at KNE Realty in Southeast Michigan.

Post a Comment